Creating a Legacy: The Case for Charitable Life Insurance

By Gregory A. Lopez CFP®, CLU®, President of Marcum Insurance Services

With many families passionate about perpetuating the mission of the charities they love, charitable planning has become an important and fulfilling piece of the legacy planning process.

Charitable giving offers many benefits to both charities and donors. Beyond funding that furthers their cause, charities are also often tax-exempt, which means they receive the full value of the transferred asset. As for the family making the gift, they:

- Typically receive a charitable income tax deduction.

- Typically avoid capital gains tax on highly appreciated assets.

- Often receive gift tax savings and/or a reduction in estate tax.

- Could potentially create an income stream from transferred assets.

- Could diversify a concentrated stock position without realizing immediate taxation.

- Can replace tax inefficient assets given to charity during their lifetimes with tax-efficient life insurance proceeds at the donor’s death.

Giving the Gift of Life Insurance

A gift of life insurance can significantly benefit a charity. The most common ways to give life insurance include the following:

Transfer an Existing Policy or Establish a New Policy

If you own a policy you no longer need, you may consider transferring it to a charity or foundation. Be aware that before accepting ownership of a life insurance policy, some charities may require the donor to commit to making annual cash gifts to cover the premiums. That said, many large charitable organizations have insurance gifting programs in place and pay premiums on behalf of the donor.

Gifting an existing life insurance policy may allow you to take a sizeable income tax deduction in the year gifted. Subsequent gifts to pay premiums may provide additional annual income tax deductions. Outstanding policy loans at the time of the transfer may affect the availability of a tax deduction.

If you have a policy with a surrender value or settlement value, a charitable organization may choose to sell the policy once it’s transferred so that it can use the funds immediately.

The following chart illustrates the tax deduction a donor may receive by donating an existing policy to charity.

|

Existing Policy Death Benefit

|

Cost Basis

|

Fair Market Value

|

Income Tax Deduction (Lesser of FMV or Cost Basis)

|

AGI Limitation Year 1* (50% of $500,000 AGI)

|

Income Tax Savings Year 1 (35% Tax Rate)

|

Carry-Over Deduction (Year 2)

|

|---|---|---|---|---|---|---|

|

$5,000,000

|

$375,000

|

$390,000

|

$375,000

|

$250,000

|

$87,500

|

$125,000

|

- This example assumes an Adjusted Gross Income (AGI) of $500,000 and life insurance is transferred to a public charity.

The chart below illustrates what an annual gift of $50,000 can provide to a charity as a bequest at death in the form of life insurance.

|

Annual Gift (Charity uses to pay Premium)

|

Annual Income Tax Deduction

|

Annual Income Tax Savings (35% Tax Rate)

|

Benefit Provided to Charity

|

|---|---|---|---|

|

$50,000

|

$50,000

|

$17,500

|

$7,700,000

|

- James age 54, Chris age 52 – Survivorship Policy

- This example assumes an Adjusted Gross Income (AGI) of $500,000 and that the life insurance is transferred to a public charity

Name a Charity as the Beneficiary

You can name a charity as a beneficiary of your existing life insurance policy, but you won’t get an income tax deduction because you still have ownership rights, including the ability to change beneficiaries. In this case, upon your death your taxable estate should receive an estate tax charitable deduction for the full value of the proceeds transferred to charity.

Benefits of INCLUDING life insurance in your charitable planning

Maximizing Charitable Intentions

If your goal is to amplify your charitable giving, it may make sense for your favorite charity to own a policy on your life. The annual gifts you make to the charity in the amount of the policy’s premiums are tax-deductible and can provide current tax savings.

Wealth Replacement

When you make a gift to charity, the asset and all of its future growth reduce the value of your estate and, therefore, the amount your heirs will receive at your passing. Your life insurance can help replace the value lost to heirs and may do so tax-effectively due to the tax-free death benefit. Combined with an Irrevocable Life Insurance Trust (ILIT), this strategy can be very impactful to the after-tax (income tax and estate tax) value you leave to your heirs.

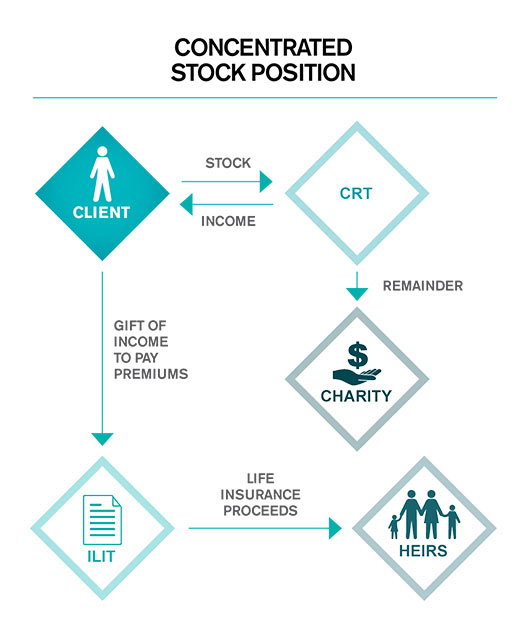

Diversifying a Concentrated Stock Position

If you wish to diversify a concentrated stock position but do not want to trigger immediate income taxes, a Charitable Remainder Trust (CRT) may be an appropriate solution. Contributing stock to the CRT does not trigger income taxes up front, and you may qualify for a tax deduction for the transfer. When the CRT diversifies the stock (by selling it at a highly appreciated value), no tax is recognized because the trust is a tax-exempt entity. You will only recognize tax from the CRT as you receive income payments.

Your heirs will lose a portion of your stock’s value because of the remainder value paid to the charity. Because of this, many CRT donors use some or all of the income received from the CRT to purchase life insurance to help make up the family’s loss. If your estate may be subject to estate taxes, consider purchasing the life insurance policy inside of an Irrevocable Life Insurance Trust (ILIT) to keep the death benefit proceeds outside of your taxable estate. This type of trust is funded during your lifetime with one or more life insurance policies. Death benefit proceeds are not part of the insured’s gross estate and thus not subject to state and federal estate taxation.

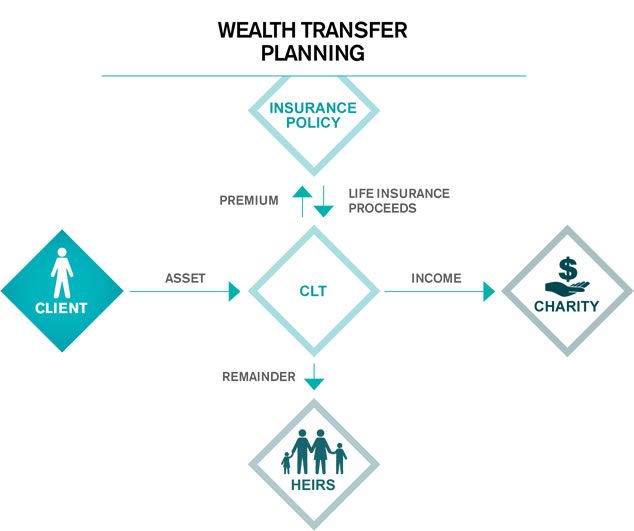

Wealth Transfer Planning

If protecting and preserving wealth for future generations is a concern, the use of a non-grantor CLT may provide substantial gift tax savings and a reduced taxable estate, while leveraging wealth for your family. A non-grantor CLT has readily available funds growing outside the taxable estate that may be leveraged with life insurance to significantly increase the amount you ultimately transfer to your heir.

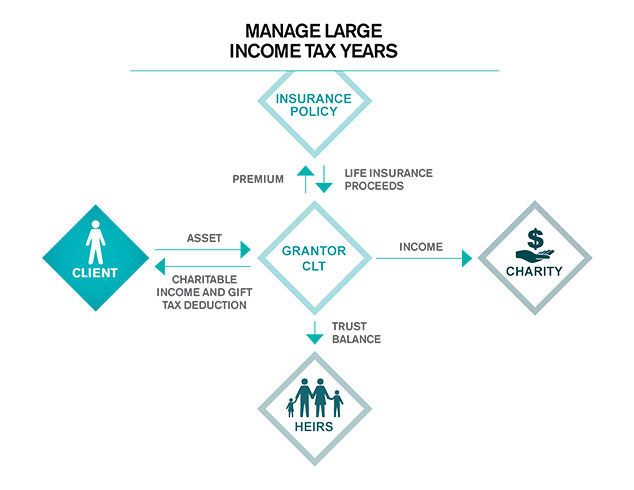

Coordinating Charitable Planning with Large Income Tax Years

If you have substantial income in a single year because you sold a business, received a large bonus, or possibly executed stock options, a grantor charitable lead trust (CLT) may provide an immediate income tax deduction to help minimize your tax exposure. A grantor may consider using a portion of the trust principal to buy a life insurance policy to potentially leave more value to their heirs after the charitable term ends.

Marcum’s Insurance Services team is available to discuss how life insurance can help protect your family, achieve your estate planning goals and leave a lasting legacy for the people and organizations closest to you.

*CFP Board owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S.

*Marcum Insurance Services, LLC is an affiliated insurance agency of Marcum Wealth, LLC. Marcum Wealth, LLC may recommend the services of certain affiliated and related entities, including Marcum, LLP and Marcum Insurance Services, LLC, which presents a conflict of interest in that the recommendation could be made on the basis of fees to be collected by such affiliated or related entity.

*Securities offered through Valmark Securities, Inc. Member FINRA, SIPC. Advisory Services Offered through Marcum Wealth, a SEC registered Investment Advisor. Marcum Wealth and Marcum Insurance Services are separate from Valmark Securities, Inc.

*The information presented here is for educational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. Actual results may vary. All examples are hypothetical in nature and are for illustrative purposes only.

* Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Marcum.