Start-Up Company with Insurance Needs

Shareholder agreements, life insurance trust, difficult justification of death benefits

Recently a Marcum LLP CPA engaged us to review the insurance needs for a startup company. The company has 4 partners and no revenue to date. They have a shareholder agreement that states if any individual shareholder or principal dies, the surviving shareholders shall purchase no less than 100% of the shares from the deceased shareholderʼs estate. It also states a mandate that the company must maintain such coverage, in good standing at all times.

Upon the initial discussion with the CFO, we noticed the shareholder agreement did not mention what happens at the event of disability of a shareholder. They found this to be both important and missing so the agreement will be amended to refl ect this need. This coverage is placed through Lloyds of London and provides a lump sum benefit of $10,000,000 in the event of permanent disability with a 12 month elimination period.

A buy/sell agreement can be structured in a number of ways. Traditionally, each partner owns a policy on each other. This is referred to as a cross purchase. The benefit is the purchasing owner receives a step up in basis because they are purchasing the shares at the new valuation. The drawback is that partnerships of 3 or more require many policies. In the case of 4 partners, each will own 3 policies for a total of 12 policies. Traditionally an entity purchase would be established in this scenario. An entity purchase is where the business owns the policies. At death the surviving shareholders receive a reverse delusion of shares but do not receive a stepped up basis. Our solution was to recommend an Insurance LLC. This is the best of both worlds, enjoying simplicity of a single policy on each owner and a step up in basis.

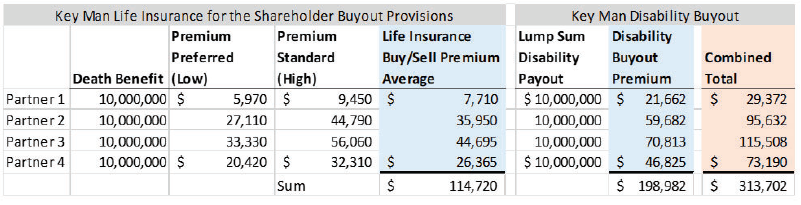

Below are the insurance designs recommended. They are 20 year, guaranteed convertible term insurance with optional disability buyout.

A properly designed buy/sell plan starts with the legal agreement and is nearly always funded with insurance. If a partner dies, the benefit is the spouse of the deceased partner has immediate cash in the amount in the share of the business ownership. The benefit of the surviving owners is they cleanly absorb the shares of the deceased owner and have no further obligations to the family of the deceased owner.

*Marcum Insurance Services, LLC is an affiliated insurance agency of Marcum Wealth, LLC. Marcum Wealth, LLC may recommend the services of certain affiliated and related entities, including Marcum, LLP and Marcum Insurance Services, LLC, which presents a conflict of interest in that the recommendation could be made on the basis of fees to be collected by such affiliated or related entity.

*Securities offered through Valmark Securities, Inc. Member FINRA, SIPC. Advisory Services Offered through Marcum Wealth, a SEC registered Investment Advisor. Marcum Wealth and Marcum Insurance Services are separate from Valmark Securities, Inc.

*The information presented here is for educational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. Actual results may vary. All examples are hypothetical in nature and are for illustrative purposes only.

* Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

*Marcum is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Marcum.

*The guarantees offered by insurance policies are limited to the claims paying ability of the issuing insurance company.