Life Settlement 2023

A client reached out to his Marcum CPA that he relies on for his tax work. He told the CPA that he wanted to surrender two life insurance policies for their cash value. The policies were a corporate benefit and he never paid premiums into the policies himself. The client’s employer paid the premiums on his behalf. Now Retired, he reached out to his CPA to confirm the tax treatment of surrendering policies in exchange for the cash value proceeds.

Facts

- Client is widowed and in his late 70’s

- He lives in Florida and has a few health impairments.

- $21,000,000 Death benefit between 2 policies

- $1,700,000 Cash Surrender Value

- The policies were only funded by the employer while the client was employed. The client did not make any premium payments post-retirement, therefore, the policies has been consuming the cash value at a rapid pace.

- The cash value will be consumed by the policies in about 5-6 years, causing the policies to lapse and become worthless The client has no interest in paying the premiums, which would amount to $300,000+ annually.

- The client has assets large enough where he will have about $30,000,000 of a taxable estate.

- The existing Policies are owned by his trust with a note due back to the client of about $1,500,000

- The reason the client wanted to cash out his policies was to fulfill charitable intentions during his lifetime and see them go to use instead of a bequest at death.

How it started

- We had an initial discussion with the CPA who expressed the interest of his client to surrender the policies. However, this CPA attended a webinar where we discussed Life Settlements; an alternative to surrendering a life insurance policy that can lead to a greater value received as compared to surrender. : A life settlement is the sale of existing insurance by the owners to a third party Institutional investors.

- The client signs documents, allowing Marcum Insurance to become the agents on the original policies. Once we are named agent, we obtained the necessary information about the policies. It was clear that this client would gain significantly more value from the policies from an initial review.

The Results

- The client went through the settlement process, which involves medical record collection but does not involve the client taking a medical exam.

- The sale of the policies is controlled through an auction process. Roughly 20 investment companies, in the business of investing in mature life insurance policies are provided 2-3 weeks to give their best offer for the policies. We closed the auction with a cash offer of $10,100,0000 which the client accepted.

- The total value created for the client I was $ 8,400,000. Total offer less the cash surrender value.

- The client’s note due of $1,500,000 from the trust will get paid to him directly and the remainder will be held inside his irrevocable trust, insulating it from estate taxes.

Tax Treatment

- The client will realize a gain in excess of the cost basis of the policies. A life settlement is treated as a sale of a capital asset and enjoys long term capital gains rates.

- If the client were to surrender the policies, the gain would be ordinary income.

Estate Considerations

- Because the client’s trust is the owner of the policies, a significant benefit exists. If the policies were owned inside the estate, sale proceeds or death benefits would be added to the overall estate value, already exceeding the lifetime exclusion amount of $12,900,000 per individual in 2023. This would create an estate tax of $3,360,000 on just the proceeds received. ($8.4M x 40%)

- However, past planning placed these policies outside of the client’s taxable estate and the cash proceeds will be included in the irrevocable trust for the benefit of his children. This results in no estate tax owed upon the client’s passing.

Key Takeaways

- Most client opportunities we see come from a basic policies audit. A policy audit is a review and analysis of a policy owner’s life insurance coverage. Opportunities like this and many others come from a Marcum CPA or advisor simply asking the client the question… can we complete a complimentary review of your existing insurance?

- Ideal Candidate for a Life Settlement

- Owner of a policy no longer needs or wants the insurance coverage. Examples…

- Policy was for a business need and the business no longer requires it

- Policy premiums have become too high for the client’s cash flow

- Death benefit is no longer needed

- The insured is age 70 or older with health impairments.

- Owner of a policy no longer needs or wants the insurance coverage. Examples…

- Any form of insurance can possible qualify for a settlement; Permanent or Term Insurance.

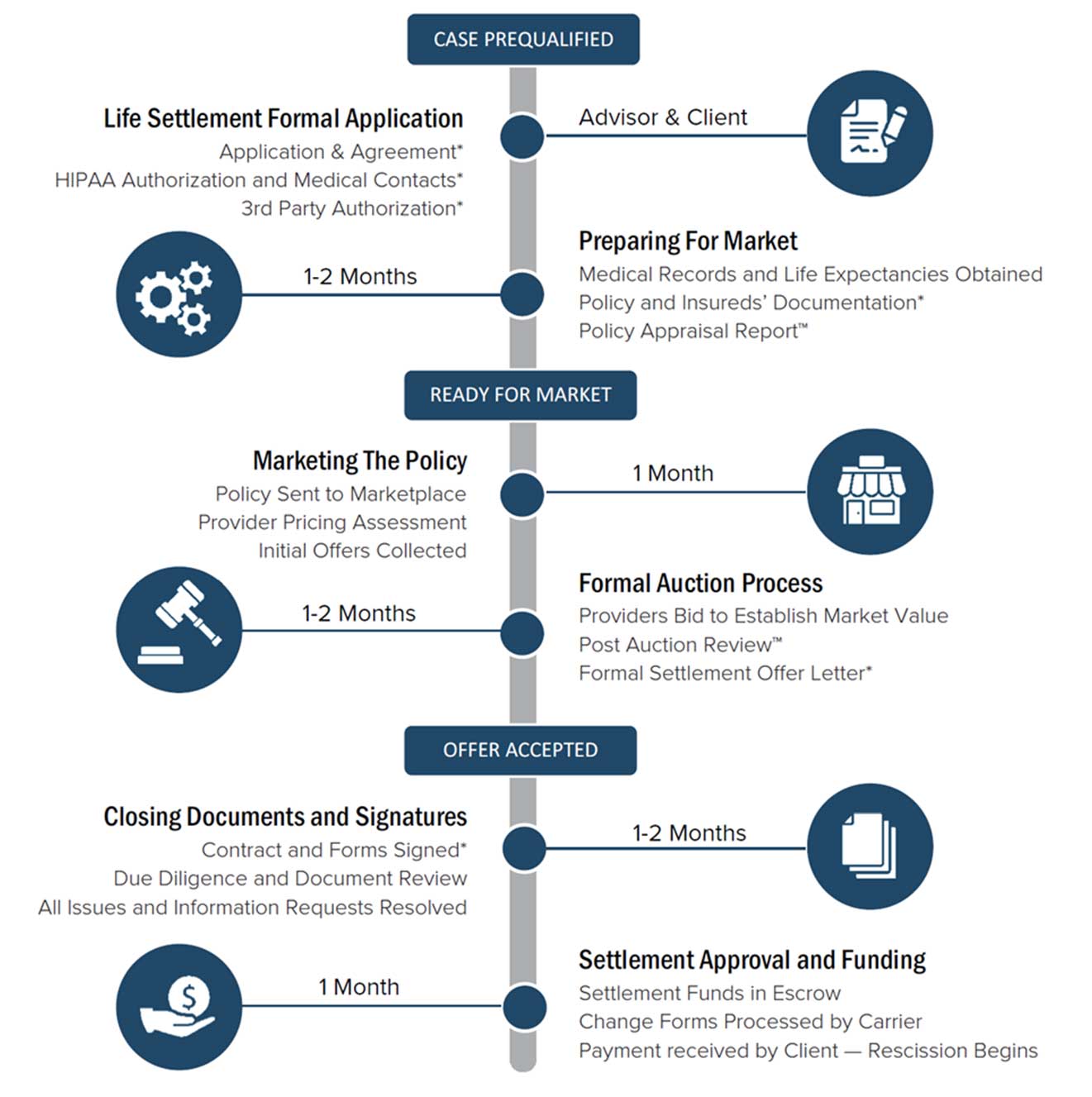

Life Settlement Process and Timeline

Important Disclosure Information

Securities offered through Valmark Securities, Inc. Member FINRA/SIPC. Investment advisory services offered through Marcum Wealth, LLC., a SEC Registered Investment Advisor or Valmark Advisers, Inc. an SEC Registered Investment Advisor. Marcum Wealth, LLC and Marcum Insurance Services are separate entities from Valmark Securities, Inc. and Valmark Advisers, Inc. 130 Springside Drive, Akron, Ohio 44333. (800) 765-5201. FINRA | SEC

Valmark and its registered representatives act as brokers on the transaction and will receive a fee from the purchaser. Valmark supervises all life settlements like a security transaction. Life Settlement Providers: Valmark markets policies only to Life Settlement Providers. Life Settlement Providers are generally responsible for maintaining the policy after sale and receive their funding from institutional buyers. Valmark reviews Life Settlement Providers periodically to affirm that their funding sources are institutional buyers, carry errors and omissions insurance, and are licensed in the state of sale. Institutional Buyers: Institutional buyers include qualified institutions, accredited investors, hedge funds, pension funds, and other qualifying investors. Investors bundle policies to ease any concerns with strangers having access to view millions of death benefit on an individual. In a life settlement agreement, the current life insurance policy owner transfers the ownership and beneficiary designations to a third party, who receives the death proceeds at the passing of the insured. As a result, this buyer has a financial interest in the seller’s death. A policy owner should consider the continued need for coverage, and, if the policy owner plans to replace the existing policy with another policy, the policy owner should consider the availability, adequacy, and cost of comparable coverage. Policy owners considering the need for cash should consider other less costly alternatives to a life settlement. *When an individual decides to sell their policy, they must provide complete access to their medical history, and other personal information, that may affect their life expectancy. This information is requested during the initial application for a life settlement. After the completion of the sale, there may be an ongoing obligation to disclose similar and additional information to the buyer or servicing agent at a later date. A life settlement may affect the insured’s ability to obtain insurance in the future and the seller’s eligibility for certain public assistance programs, such as Medicaid, and there may be tax consequences. Individuals should discuss the taxation of the proceeds received from a life settlement with their tax advisor. A life settlement transaction may require an extended period of time to complete. Due to complexity of the transaction, fees and costs incurred with the life settlement transaction may be substantially higher than other securities. Once the policy is transferred, the policy owner has no control over subsequent transfers. Each client’s experience varies, and there is no guarantee that a life settlement will generate an offer greater than the current cash surrender value. In such cases, the client can always surrender their policy to the carrier if the coverage is no longer needed. The gross offer will be reduced by commissions and expenses related to the sale.